Performance-Based Insurance: Unlocking Substantial Savings for Your Business

In the fiercely competitive business landscape, minimizing expenses and maximizing profits is paramount. One often-overlooked avenue for achieving these goals is performance-based insurance, an innovative approach to risk management that can save your company significant sums of money.

Unveiling the Potential of Performance-Based Insurance

Performance-based insurance (PBI) differs from traditional insurance policies by aligning premiums with the insured's actual performance. This means that companies with a proven track record of risk management and loss prevention can enjoy lower premiums, while those with higher risk profiles will pay a higher price.

4.6 out of 5

| Language | : | English |

| File size | : | 275 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 64 pages |

| Lending | : | Enabled |

By incentivizing proactive risk management, PBI fosters a culture of safety and responsibility within organizations. This ultimately leads to a reduction in accidents, injuries, and other costly incidents, resulting in tangible savings for your business.

Benefits of Performance-Based Insurance

The advantages of PBI extend beyond cost savings:

- Improved Risk Management: PBI encourages businesses to identify and mitigate risks, fostering a safer and more efficient work environment.

- Reduced Insurance Premiums: Companies with strong safety records and effective risk management strategies can qualify for lower premiums.

- Increased Control Over Costs: By influencing your company's insurance costs through performance, you gain greater control over your insurance expenses.

- Enhanced Competitiveness: Lower insurance premiums translate into increased competitiveness and improved profit margins.

Types of Performance-Based Insurance Policies

PBI policies come in various forms, each tailored to specific industries and risks:

- Workers' Compensation Insurance: Premiums are based on actual safety performance and claims experience.

- Commercial Auto Insurance: Premiums are adjusted based on driving history and fleet management practices.

- Property Insurance: Premiums are influenced by loss prevention measures and risk mitigation initiatives.

- Environmental Insurance: Premiums are tied to compliance with environmental regulations and pollution control practices.

Implementing a Performance-Based Insurance Program

To successfully implement a PBI program, businesses should:

- Conduct a Risk Assessment: Identify and prioritize risks that could affect insurance costs.

- Develop a Risk Management Plan: Outline steps to mitigate risks and prevent losses.

- Establish Performance Metrics: Define specific targets and indicators to measure risk management success.

- Partner with an Insurer: Select an insurer that provides PBI policies and offers support for performance improvement.

Case Studies of PBI Success

Numerous businesses have witnessed the transformative impact of PBI:

- Manufacturing Company: Reduced workers' compensation premiums by 25% through improved safety practices and accident prevention.

- Transportation Company: Lowered commercial auto insurance costs by 15% due to enhanced fleet management and reduced accidents.

- Healthcare Facility: Achieved a 10% discount on property insurance premiums by implementing comprehensive fire prevention and protection systems.

Performance-based insurance is a game-changer in the realm of risk management. By aligning premiums with performance, businesses can unlock substantial savings, foster a culture of safety, and enhance their competitiveness. By embracing PBI, your company can reap the many benefits and safeguard its financial future.

4.6 out of 5

| Language | : | English |

| File size | : | 275 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 64 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Alex Storozynski

Alex Storozynski Paul Ingrassia

Paul Ingrassia Mary Kay Cunningham

Mary Kay Cunningham 1st Ed 2018 Edition Kindle Edition

1st Ed 2018 Edition Kindle Edition David Blixt

David Blixt Matthew Bernstein

Matthew Bernstein Don Whitehead

Don Whitehead David Avrom Bell

David Avrom Bell Gina Devee

Gina Devee George Cohon

George Cohon Tom Wright

Tom Wright Isabel Stenzel Byrnes

Isabel Stenzel Byrnes Kai Bird

Kai Bird 3rd Edition Kindle Edition

3rd Edition Kindle Edition Douglas Botting

Douglas Botting Matt Alt

Matt Alt Joseph Lelyveld

Joseph Lelyveld Phil Burks

Phil Burks Maria Grammatico

Maria Grammatico Kim E Nielsen

Kim E Nielsen

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jacques BellThe Rediscovered Benjamin Graham: Unlocking the Secrets of Value Investing in...

Jacques BellThe Rediscovered Benjamin Graham: Unlocking the Secrets of Value Investing in...

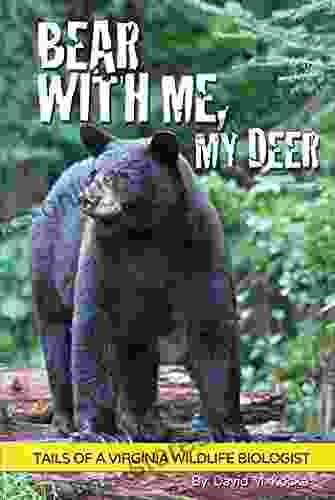

Travis FosterBear With Me My Deer: An Enchanting Tale of Friendship and Adventure in the...

Travis FosterBear With Me My Deer: An Enchanting Tale of Friendship and Adventure in the... Octavio PazFollow ·6.9k

Octavio PazFollow ·6.9k Ryūnosuke AkutagawaFollow ·4.9k

Ryūnosuke AkutagawaFollow ·4.9k Henry Wadsworth LongfellowFollow ·5k

Henry Wadsworth LongfellowFollow ·5k Robin PowellFollow ·19.3k

Robin PowellFollow ·19.3k Gary CoxFollow ·7.3k

Gary CoxFollow ·7.3k Sam CarterFollow ·11.6k

Sam CarterFollow ·11.6k Robert ReedFollow ·6.4k

Robert ReedFollow ·6.4k Ike BellFollow ·3k

Ike BellFollow ·3k

Hank Mitchell

Hank MitchellStories of War from the Women Reporters Who Covered...

The Vietnam War was one of the most...

George Bell

George BellThe Hero and Saint of Islam: A Perennial Philosophy

Ali ibn Abi Talib,...

Samuel Ward

Samuel WardWhispers and Shadows: A Naturalist's Memoir of Encounters...

In her lyrical...

Clarence Brooks

Clarence BrooksRace, Gender, and Intellectual Property Rights in...

Dance is a powerful...

Kirk Hayes

Kirk HayesThe Political Odyssey of Nick Galifianakis: From...

The American...

Dean Butler

Dean ButlerGuibert of Nogent: A Portrait of the Medieval Mind

Guibert of Nogent was a...

4.6 out of 5

| Language | : | English |

| File size | : | 275 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 64 pages |

| Lending | : | Enabled |