An Investment Framework For Predicting The Future: A Comprehensive Guide

Predicting the future is a daunting task, but it is essential for investors who want to make informed decisions and increase their chances of success in the financial markets. While there is no surefire way to predict the future, there are a number of frameworks and tools that can help investors make more accurate predictions.

This article provides a comprehensive investment framework for predicting the future. It covers key factors to consider, models to use, and strategies to implement. By following this framework, investors can increase their chances of making profitable investment decisions.

When predicting the future, it is important to consider a number of key factors, including:

4.5 out of 5

| Language | : | English |

| File size | : | 18592 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 296 pages |

| Lending | : | Enabled |

- Economic indicators: Economic indicators provide insights into the health of the economy and can help investors predict future trends. Some of the most important economic indicators to consider include GDP growth, unemployment rate, inflation rate, and consumer confidence.

- Geopolitical factors: Geopolitical factors can have a significant impact on the financial markets. Investors should be aware of major geopolitical events, such as wars, elections, and trade disputes.

- Behavioral finance: Behavioral finance studies the psychological factors that influence investment decisions. By understanding how investors behave, investors can make more informed decisions and avoid common pitfalls.

- Market analysis: Market analysis involves studying the price movements of stocks, bonds, and other financial instruments. By analyzing market data, investors can identify trends and make predictions about future price movements.

There are a number of different models that investors can use to predict the future. Some of the most popular models include:

- Technical analysis: Technical analysis uses historical price data to identify trends and patterns. Technical analysts believe that these trends and patterns can be used to predict future price movements.

- Fundamental analysis: Fundamental analysis focuses on the underlying fundamentals of a company, such as its earnings, cash flow, and debt. Fundamental analysts believe that these fundamentals can be used to predict a company's future stock price.

- Quantitative analysis: Quantitative analysis uses mathematical and statistical models to predict future price movements. Quantitative analysts believe that these models can be used to identify undervalued and overvalued stocks.

Once investors have considered the key factors and models, they can implement a number of strategies to predict the future. Some of the most common strategies include:

- Long-term investing: Long-term investing is a strategy that involves holding stocks for a period of years or decades. Long-term investors believe that the stock market will eventually recover from any short-term fluctuations.

- Risk management: Risk management is a strategy that involves managing the risk of an investment portfolio. Risk managers use a variety of tools and techniques to reduce the risk of their portfolios.

- Asset allocation: Asset allocation is a strategy that involves dividing an investment portfolio into different asset classes, such as stocks, bonds, and real estate. Asset allocators believe that this diversification will reduce the risk of their portfolios.

Predicting the future is a complex and challenging task, but it is essential for investors who want to make informed decisions and increase their chances of success. By following the investment framework outlined in this article, investors can increase their chances of making profitable investment decisions.

Remember, however, that there is no surefire way to predict the future. Even the most experienced investors can make mistakes. The key is to be aware of the risks involved and to make investment decisions based on sound research and analysis.

4.5 out of 5

| Language | : | English |

| File size | : | 18592 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 296 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Paul Lancaster

Paul Lancaster Tony Blackman

Tony Blackman Mike Freeman

Mike Freeman Inbal Arieli

Inbal Arieli Alan Robert Ginsberg

Alan Robert Ginsberg Marc Raboy

Marc Raboy Peter Salmon Ba

Peter Salmon Ba Cassandra Vivian

Cassandra Vivian Lisa Shawver

Lisa Shawver Jonathan Cohn

Jonathan Cohn Lee Kelley

Lee Kelley Dwight Heck

Dwight Heck Jessica Dulong

Jessica Dulong Napoleon Hill

Napoleon Hill Michael Schuman

Michael Schuman Molly Caro May

Molly Caro May Virginia Cowles

Virginia Cowles Jeanne Moore

Jeanne Moore Tekeema Smith Shields

Tekeema Smith Shields Kai Fu Lee

Kai Fu Lee

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

William ShakespeareBusiness Ethics Lessons Learned: Case Studies and Practical Applications

William ShakespeareBusiness Ethics Lessons Learned: Case Studies and Practical Applications

Howard PowellThe Inside Story of Organized Cybercrime: From Global Epidemic to Your Front...

Howard PowellThe Inside Story of Organized Cybercrime: From Global Epidemic to Your Front...

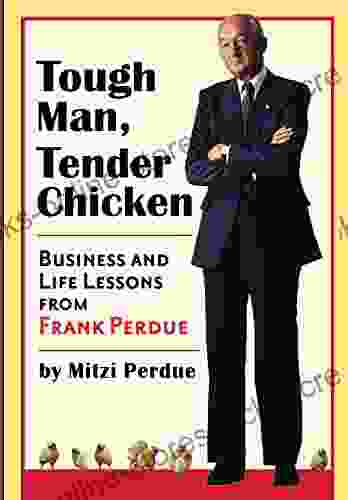

Fernando PessoaBusiness and Life Lessons from Frank Perdue: A Journey of Innovation and...

Fernando PessoaBusiness and Life Lessons from Frank Perdue: A Journey of Innovation and... Herb SimmonsFollow ·16.4k

Herb SimmonsFollow ·16.4k Justin BellFollow ·2.5k

Justin BellFollow ·2.5k Samuel BeckettFollow ·2.8k

Samuel BeckettFollow ·2.8k Jerry HayesFollow ·7.9k

Jerry HayesFollow ·7.9k Bill GrantFollow ·14.4k

Bill GrantFollow ·14.4k Roland HayesFollow ·16.2k

Roland HayesFollow ·16.2k Camden MitchellFollow ·6.7k

Camden MitchellFollow ·6.7k Hudson HayesFollow ·19.2k

Hudson HayesFollow ·19.2k

Hank Mitchell

Hank MitchellStories of War from the Women Reporters Who Covered...

The Vietnam War was one of the most...

George Bell

George BellThe Hero and Saint of Islam: A Perennial Philosophy

Ali ibn Abi Talib,...

Samuel Ward

Samuel WardWhispers and Shadows: A Naturalist's Memoir of Encounters...

In her lyrical...

Clarence Brooks

Clarence BrooksRace, Gender, and Intellectual Property Rights in...

Dance is a powerful...

Kirk Hayes

Kirk HayesThe Political Odyssey of Nick Galifianakis: From...

The American...

Dean Butler

Dean ButlerGuibert of Nogent: A Portrait of the Medieval Mind

Guibert of Nogent was a...

4.5 out of 5

| Language | : | English |

| File size | : | 18592 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 296 pages |

| Lending | : | Enabled |