Unlocking the Edge: A Comprehensive Guide to Options Trading for Beginners

Welcome to the ever-evolving world of options trading, where savvy investors harness the power of complex financial instruments to unlock exceptional returns. As a beginner, navigating the complexities of this market can seem like a daunting task. But fear not! This comprehensive guide will provide you with a solid foundation, equipping you with the knowledge and strategies to navigate the options landscape with confidence.

Understanding Options

Options are financial contracts that derive their value from an underlying asset, such as stocks, bonds, currencies, or commodities. They grant investors the right, but not the obligation, to buy or sell the underlying asset at a specific price on or before a predetermined date.

4.3 out of 5

| Language | : | English |

| File size | : | 31275 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 242 pages |

There are two primary types of options: calls and puts. Calls give the holder the right to buy the underlying asset, while puts give the holder the right to sell.

Key Concepts

To fully grasp the mechanics of options trading, let's delve into some key concepts:

Expiration Date: The date on which the option contract expires. After this date, the option loses its value.

Strike Price: The predetermined price at which the holder can buy or sell the underlying asset.

Premium: The price paid to acquire an option contract.

In-the-Money (ITM): When the current market price of the underlying asset is favorable to the option holder.

Out-of-the-Money (OTM): When the current market price of the underlying asset is unfavorable to the option holder.

At-the-Money (ATM): When the current market price of the underlying asset is equal to the strike price.

Benefits of Options Trading

Mastering options trading can open up a world of opportunities for investors:

Leverage: Options provide investors with leverage, allowing them to control a larger position with a smaller investment.

Income Generation: By selling options, investors can generate premium income, regardless of market direction.

Risk Management: Options can be used to hedge against potential losses or enhance portfolio returns.

Speculation: Options offer the potential for significant returns through speculative trading.

Getting Started

Before jumping into the options trading arena, it's essential to equip yourself with the necessary tools and knowledge:

Education: Enroll in courses, read books, and seek mentorship to gain a thorough understanding of options trading.

Brokerage Account: Open an account with a reputable brokerage firm that offers options trading services.

Funding: Determine your investment capital and ensure you have sufficient funds to cover option premiums and potential losses.

Strategies for Beginners

As a beginner, it's wise to focus on simple strategies that limit risk while maximizing potential returns:

Covered Calls: Sell a call option while owning the underlying asset. This strategy generates premium income and limits potential upside.

Cash-Secured Puts: Sell a put option while holding cash equivalent to the value of the underlying asset. This strategy generates premium income and provides downside protection.

Bull Call Spreads: Buy a lower-strike call option and sell a higher-strike call option with the same expiration date. This strategy limits risk and provides upside potential.

Bear Put Spreads: Buy a higher-strike put option and sell a lower-strike put option with the same expiration date. This strategy limits risk and provides downside protection.

Risk Management

Options trading involves inherent risks, so it's crucial to implement prudent risk management practices:

Understand the Risks: Thoroughly assess the potential risks associated with each option strategy before executing trades.

Monitor Positions: Regularly monitor your option positions to track performance and adjust strategies as needed.

Set Stop-Loss Orders: Use stop-loss orders to limit potential losses.

Diversify Portfolio: Spread your investments across multiple options strategies and underlying assets to reduce risk.

Options trading can be a rewarding endeavor, but it requires a solid understanding of the concepts, strategies, and risks involved. By embracing the knowledge and insights provided in this comprehensive guide, aspiring investors can confidently navigate the options market and unlock its potential for exceptional returns. Remember, with patience, perseverance, and a disciplined approach, you can harness the power of options to enhance your investment portfolio and achieve financial success.

4.3 out of 5

| Language | : | English |

| File size | : | 31275 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 242 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Marty Human

Marty Human Hannah Podob

Hannah Podob Jessica Dulong

Jessica Dulong Molly Caro May

Molly Caro May Christopher Edmonds

Christopher Edmonds William M Chace

William M Chace Alan Robert Ginsberg

Alan Robert Ginsberg Virginia Morris

Virginia Morris Bina Ramamurthy

Bina Ramamurthy Arne Perras

Arne Perras 1st Ed 2016 Edition Kindle Edition

1st Ed 2016 Edition Kindle Edition Amelia Klem Osterud

Amelia Klem Osterud Zig Ziglar

Zig Ziglar Warner Loughlin

Warner Loughlin Charles Drazin

Charles Drazin Nancy Verde Barr

Nancy Verde Barr Jonathan Feist

Jonathan Feist Guy Kawasaki

Guy Kawasaki Shaun Bythell

Shaun Bythell David E Hoffman

David E Hoffman

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

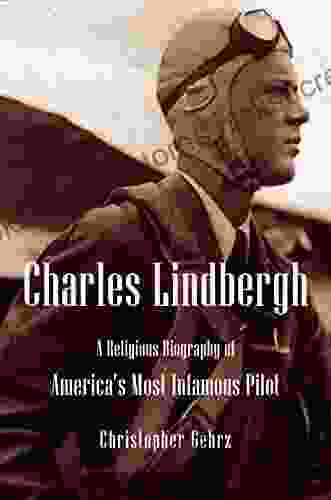

Eric NelsonUnveiling the Religious Biography of America's Most Infamous Pilot: A Library...

Eric NelsonUnveiling the Religious Biography of America's Most Infamous Pilot: A Library... George Bernard ShawFollow ·5.3k

George Bernard ShawFollow ·5.3k VoltaireFollow ·11k

VoltaireFollow ·11k Jean BlairFollow ·12.8k

Jean BlairFollow ·12.8k Brent FosterFollow ·16.2k

Brent FosterFollow ·16.2k Adam HayesFollow ·4.5k

Adam HayesFollow ·4.5k Elliott CarterFollow ·5.2k

Elliott CarterFollow ·5.2k Aldous HuxleyFollow ·14k

Aldous HuxleyFollow ·14k Roald DahlFollow ·2.6k

Roald DahlFollow ·2.6k

Hank Mitchell

Hank MitchellStories of War from the Women Reporters Who Covered...

The Vietnam War was one of the most...

George Bell

George BellThe Hero and Saint of Islam: A Perennial Philosophy

Ali ibn Abi Talib,...

Samuel Ward

Samuel WardWhispers and Shadows: A Naturalist's Memoir of Encounters...

In her lyrical...

Clarence Brooks

Clarence BrooksRace, Gender, and Intellectual Property Rights in...

Dance is a powerful...

Kirk Hayes

Kirk HayesThe Political Odyssey of Nick Galifianakis: From...

The American...

Dean Butler

Dean ButlerGuibert of Nogent: A Portrait of the Medieval Mind

Guibert of Nogent was a...

4.3 out of 5

| Language | : | English |

| File size | : | 31275 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 242 pages |