The Ultimate Retirement Guide For 50: Planning, Saving, and Enjoying Your Golden Years

Retirement is a major life event that requires careful planning and preparation. If you're approaching 50, it's time to start thinking about your retirement goals and how you're going to achieve them.

This guide will provide you with everything you need to know about retirement planning, from saving strategies to investment options and lifestyle considerations. By following the advice in this guide, you can set yourself up for a comfortable and secure retirement.

Saving for Retirement

One of the most important aspects of retirement planning is saving money. The sooner you start saving, the more time your money has to grow. There are a number of different ways to save for retirement, including:

4.6 out of 5

| Language | : | English |

| File size | : | 3457 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 311 pages |

- 401(k) plans: 401(k) plans are employer-sponsored retirement plans that allow you to save pre-tax dollars. Your contributions are invested in a variety of funds, and you can choose how your money is invested.

- IRAs: IRAs are individual retirement accounts that allow you to save for retirement on your own. There are two types of IRAs: traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deferred growth, while Roth IRAs offer tax-free growth.

- Annuities: Annuities are insurance contracts that provide you with a guaranteed income stream for life. Annuities can be a good option for people who want to ensure that they have a steady income in retirement.

Investing for Retirement

Once you've started saving for retirement, it's time to start investing your money. Investing can help your money grow faster than it would if you simply kept it in a savings account. However, it's important to remember that investing involves risk. The value of your investments can go up or down, and you could lose money.

There are a number of different ways to invest for retirement, including:

- Stocks: Stocks represent ownership in a company. When you buy a stock, you're buying a small piece of that company. Stocks can be a good investment for long-term growth, but they can also be volatile.

- Bonds: Bonds are loans that you make to a company or government. When you buy a bond, you're lending money to the issuer. Bonds are typically less risky than stocks, but they also offer lower returns.

- Mutual funds: Mutual funds are investment companies that pool money from many investors and invest it in a variety of assets, such as stocks, bonds, and real estate. Mutual funds offer diversification, which can help to reduce risk.

Lifestyle Considerations

In addition to saving and investing for retirement, it's also important to start thinking about your lifestyle in retirement. What do you want to do with your time? Where do you want to live? How much money will you need to support your desired lifestyle?

Here are a few things to consider when planning your retirement lifestyle:

- Hobbies and interests: What do you enjoy ng? What hobbies and interests would you like to pursue in retirement?

- Travel: Do you want to travel in retirement? If so, how much money will you need to budget for travel?

- Healthcare: Healthcare costs can be a major expense in retirement. It's important to start planning for healthcare costs early so that you can avoid financial surprises later on.

- Long-term care: Long-term care is a type of care that is provided to people who need help with activities of daily living, such as bathing, dressing, and eating. Long-term care can be expensive, so it's important to start planning for it early.

Retirement Planning Timeline

Here is a suggested retirement planning timeline for people who are approaching 50:

- Age 50: Start saving for retirement and investing your money. Consider your lifestyle goals and start planning for healthcare and long-term care costs.

- Age 55: Increase your retirement savings contributions. Start thinking about when you want to retire and how much money you'll need.

- Age 60: Continue saving for retirement and investing your money. Meet with a financial advisor to review your retirement plan.

- Age 65: Retire and start enjoying your golden years!

Retirement planning can be a daunting task, but it's essential to start planning early to ensure a comfortable and secure retirement. By following the advice in this guide, you can set yourself up for a successful retirement.

4.6 out of 5

| Language | : | English |

| File size | : | 3457 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 311 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Marc Raboy

Marc Raboy Gesine Bullock Prado

Gesine Bullock Prado Vandana Shiva

Vandana Shiva Kent Anderson Leslie

Kent Anderson Leslie Rajesh Thakur

Rajesh Thakur S J Taylor

S J Taylor 2014th Edition Kindle Edition

2014th Edition Kindle Edition Aaron M Renn

Aaron M Renn Adrienne Lindholm

Adrienne Lindholm New Scientist

New Scientist Tom Burke

Tom Burke Donald L Barlett

Donald L Barlett Ted Kloski

Ted Kloski Dale Scott

Dale Scott Robert Lapham

Robert Lapham Edgar H Schein

Edgar H Schein Allan Macdonell

Allan Macdonell James Salter

James Salter Chris Enss

Chris Enss Norman A Bert

Norman A Bert

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jerry WardHow Transforming the Pursuit of Success Raises Our Achievement Happiness and...

Jerry WardHow Transforming the Pursuit of Success Raises Our Achievement Happiness and...

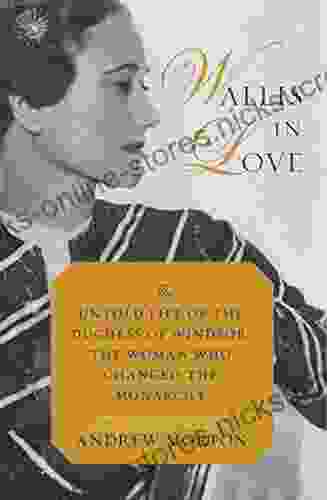

Nathaniel HawthorneThe Untold Life of the Duchess of Windsor: The Woman Who Changed the Monarchy

Nathaniel HawthorneThe Untold Life of the Duchess of Windsor: The Woman Who Changed the Monarchy Jesse BellFollow ·15.4k

Jesse BellFollow ·15.4k Patrick RothfussFollow ·10.3k

Patrick RothfussFollow ·10.3k Derrick HughesFollow ·15.5k

Derrick HughesFollow ·15.5k Hudson HayesFollow ·19.2k

Hudson HayesFollow ·19.2k Cade SimmonsFollow ·19.6k

Cade SimmonsFollow ·19.6k Ralph Waldo EmersonFollow ·12.6k

Ralph Waldo EmersonFollow ·12.6k J.D. SalingerFollow ·11.6k

J.D. SalingerFollow ·11.6k Bryson HayesFollow ·19k

Bryson HayesFollow ·19k

Hank Mitchell

Hank MitchellStories of War from the Women Reporters Who Covered...

The Vietnam War was one of the most...

George Bell

George BellThe Hero and Saint of Islam: A Perennial Philosophy

Ali ibn Abi Talib,...

Samuel Ward

Samuel WardWhispers and Shadows: A Naturalist's Memoir of Encounters...

In her lyrical...

Clarence Brooks

Clarence BrooksRace, Gender, and Intellectual Property Rights in...

Dance is a powerful...

Kirk Hayes

Kirk HayesThe Political Odyssey of Nick Galifianakis: From...

The American...

Dean Butler

Dean ButlerGuibert of Nogent: A Portrait of the Medieval Mind

Guibert of Nogent was a...

4.6 out of 5

| Language | : | English |

| File size | : | 3457 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 311 pages |