The Ultimate Investor's Guide to Consistent Lifetime Returns

4.4 out of 5

| Language | : | English |

| File size | : | 16317 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 241 pages |

As an investor, securing consistent lifetime returns is a crucial goal that requires a well-defined long-term strategy. This comprehensive guide will empower you with the knowledge and insights to navigate the investment landscape and achieve financial success throughout your lifetime.

Laying the Foundation: Establishing Your Investment Objectives

Before embarking on your investment journey, it's essential to establish clear and specific investment objectives. These objectives should align with your financial goals, risk tolerance, and time horizon. Are you seeking income generation, capital appreciation, or a combination of both? Understanding your objectives will guide your investment decisions and help you stay focused on your long-term targets.

Diversification: Spreading Your Risk

Diversification is a cornerstone of any successful investment strategy. By allocating your assets across various asset classes, sectors, and geographic regions, you can reduce the overall risk of your portfolio. This technique helps mitigate the impact of fluctuations in any single asset or market. Consider incorporating a mix of stocks, bonds, real estate, and alternative investments to achieve a well-diversified portfolio.

Asset Allocation: Balancing Risk and Returns

Asset allocation is the process of determining the appropriate proportion of each asset class in your portfolio. This decision depends on your investment objectives, risk tolerance, and time horizon. A balanced portfolio typically includes a combination of growth-oriented assets, such as stocks, and income-generating assets, such as bonds. The optimal asset allocation for you will evolve over time as your circumstances change.

Rebalancing: Maintaining Your Financial Equilibrium

Regularly rebalancing your portfolio is crucial to maintaining your desired asset allocation. Over time, market fluctuations can cause the proportions of your assets to shift away from your target. Rebalancing involves adjusting the allocation by buying and selling assets to restore the equilibrium and ensure your portfolio remains aligned with your investment objectives.

Investing for Income

For investors seeking income generation, there are several options available. Dividend-paying stocks provide a regular stream of income through dividends. Bonds, especially high-yield bonds, can offer a yield that exceeds inflation. Consider real estate investment trusts (REITs) as well, which distribute dividends from rental income.

Investing for Growth

If capital appreciation is your primary goal, growth-oriented investments are the way to go. Stocks, particularly those of high-growth companies, have historically provided significant returns over the long term. Venture capital and private equity can also provide opportunities for substantial gains, but they come with higher risks.

The Importance of Time

Time is a powerful ally for investors. The longer you invest, the greater the potential for compounding returns. Compounding is the effect of earning interest on your interest, which leads to exponential growth over time. By investing early and staying invested for the long term, you can harness the power of compounding and maximize your returns.

Risk Management: Protecting Your Wealth

Managing risk is an integral part of achieving consistent lifetime returns. Understand your risk tolerance and invest accordingly. Implement stop-loss orders to limit potential losses and diversify your portfolio to minimize the impact of market downturns. Regular monitoring of your investments is also crucial for identifying potential risks and taking appropriate actions.

Tax Optimization: Enhancing Your Returns

Tax optimization strategies can significantly enhance your lifetime returns. Utilize tax-advantaged accounts like 401(k)s and IRAs to reduce your tax liability and maximize your investment growth. Consider municipal bonds and dividend-paying stocks that offer tax benefits.

Professional Guidance: Seeking Expert Advice

For investors seeking personalized advice and guidance, consider working with a financial advisor. A qualified advisor can help you assess your financial situation, develop a tailored investment plan, and provide ongoing support. Their expertise can optimize your returns and mitigate risks.

Achieving consistent lifetime returns is a journey that requires a disciplined and long-term approach. By establishing clear investment objectives, diversifying your portfolio, rebalancing regularly, and managing risk effectively, you can increase your chances of financial success throughout your lifetime. Remember to embrace the power of compounding, leverage tax optimization strategies, and seek professional guidance when needed. With a comprehensive investment plan and unwavering commitment, you can pave the way towards a financially secure and fulfilling future.

4.4 out of 5

| Language | : | English |

| File size | : | 16317 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 241 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare William Pelfrey

William Pelfrey Finn Brunton

Finn Brunton Harold Pinter

Harold Pinter Amir Khan

Amir Khan Andrew Swap

Andrew Swap Roy Keane

Roy Keane Matthew Mcgough

Matthew Mcgough Michael J Howell

Michael J Howell Lesley Hazleton

Lesley Hazleton Stephen Jeffreys

Stephen Jeffreys Robert Cohen

Robert Cohen Phyllis Leininger

Phyllis Leininger Arlie O Petters

Arlie O Petters Gina Devee

Gina Devee New Epoch Weekly

New Epoch Weekly Randy Pausch

Randy Pausch Gerald M Loeb

Gerald M Loeb Louis Markos

Louis Markos Rosina J Hassoun

Rosina J Hassoun Kathryn Casey

Kathryn Casey

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

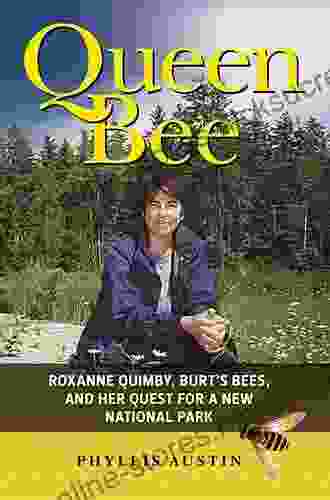

Geoffrey BlairRoxanne Quimby: The Visionary Behind Burt's Bees and Her Legacy of Nature...

Geoffrey BlairRoxanne Quimby: The Visionary Behind Burt's Bees and Her Legacy of Nature... W.B. YeatsFollow ·2.1k

W.B. YeatsFollow ·2.1k Glen PowellFollow ·2.7k

Glen PowellFollow ·2.7k Mark MitchellFollow ·4.3k

Mark MitchellFollow ·4.3k Ernest PowellFollow ·2.9k

Ernest PowellFollow ·2.9k Quentin PowellFollow ·6.2k

Quentin PowellFollow ·6.2k William FaulknerFollow ·9.2k

William FaulknerFollow ·9.2k Eddie PowellFollow ·13.7k

Eddie PowellFollow ·13.7k Gene SimmonsFollow ·12.4k

Gene SimmonsFollow ·12.4k

Hank Mitchell

Hank MitchellStories of War from the Women Reporters Who Covered...

The Vietnam War was one of the most...

George Bell

George BellThe Hero and Saint of Islam: A Perennial Philosophy

Ali ibn Abi Talib,...

Samuel Ward

Samuel WardWhispers and Shadows: A Naturalist's Memoir of Encounters...

In her lyrical...

Clarence Brooks

Clarence BrooksRace, Gender, and Intellectual Property Rights in...

Dance is a powerful...

Kirk Hayes

Kirk HayesThe Political Odyssey of Nick Galifianakis: From...

The American...

Dean Butler

Dean ButlerGuibert of Nogent: A Portrait of the Medieval Mind

Guibert of Nogent was a...

4.4 out of 5

| Language | : | English |

| File size | : | 16317 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 241 pages |