Navigating Financial Security: From 401(k)s to Social Security to Asset Management and Healthcare

Securing your financial future requires a comprehensive plan that addresses multiple aspects of your life, from retirement savings to healthcare costs. This article will delve into the intricacies of 401(k) plans, Social Security benefits, asset management, and medical planning to empower you with the knowledge and strategies necessary for financial stability and peace of mind.

401(k) Plans: A Foundation for Retirement Savings

A 401(k) plan is a tax-advantaged retirement savings plan offered by many employers. It allows you to set aside a portion of your paycheck before taxes, reducing your current income and increasing your contributions. The funds grow tax-deferred until you withdraw them in retirement.

4.5 out of 5

| Language | : | English |

| File size | : | 12489 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 269 pages |

Key Features of 401(k) Plans:

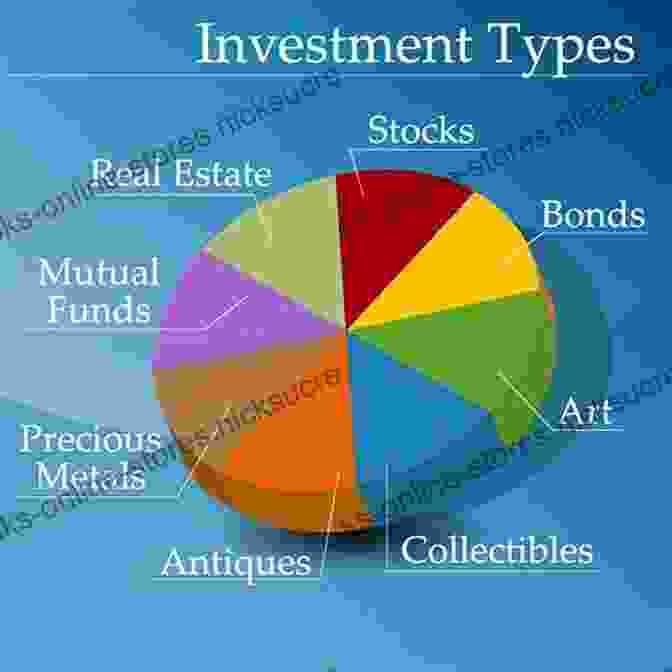

* Tax Advantages: Pre-tax contributions reduce your taxable income and potentially lower your current tax liability. Withdrawals in retirement are subject to income tax. * Employer Matching: Many employers offer matching contributions, essentially free money that can boost your retirement savings significantly. * Investment Options: 401(k) plans typically offer a range of investment options, including stocks, bonds, mutual funds, and target-date funds.

Maximizing Your 401(k) Contributions:

* Consider contributing to the maximum allowable limit, currently $22,500 per year ($30,000 for those aged 50 or older). * Take advantage of employer matching by contributing enough to receive the full match. * Regularly review your investments and make adjustments as needed to align with your retirement goals and risk tolerance.

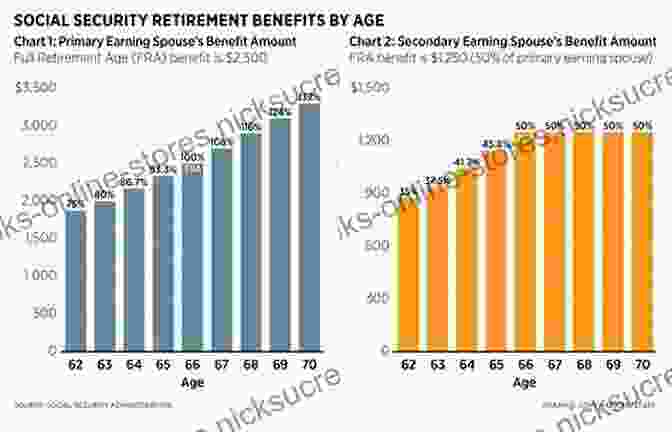

Social Security Benefits: A Vital Safety Net

Social Security is a government-run program that provides retirement, disability, and survivor benefits to eligible individuals. To qualify for benefits, you must have accrued a sufficient number of work credits through paid employment.

Key Features of Social Security Benefits:

* Retirement Benefits: Monthly payments are available to eligible individuals who have reached the retirement age, typically 66 or 67, depending on their birth year. * Disability Benefits: Individuals who become disabled before reaching retirement age may qualify for monthly payments if they meet certain eligibility requirements. * Survivor Benefits: Spouses, children, and other dependents may be eligible for survivor benefits if the primary Social Security recipient passes away.

Maximizing Your Social Security Benefits:

* Work at least 10 years to qualify for minimum benefits. * Delay claiming benefits until full retirement age (66 or 67) to receive the highest possible monthly payment. * Consider working part-time or continuing to work after reaching retirement age to increase future benefits.

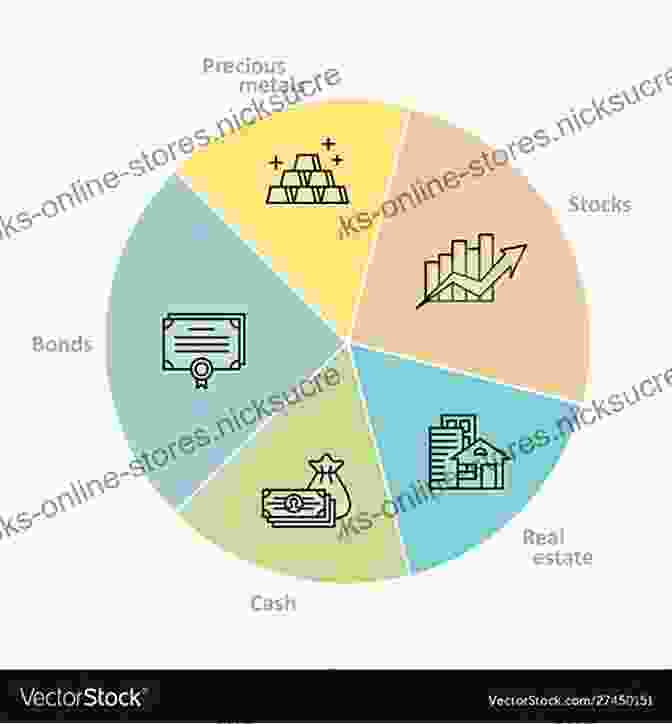

Asset Management: Preserving and Growing Your Wealth

Asset management involves managing your investments and other assets to achieve your financial goals. This includes devising an investment strategy, diversifying your portfolio, and monitoring your investments over time.

Key Aspects of Asset Management:

* Goal Setting: Define your financial goals, such as retirement, education funding, or leaving a legacy. * Investment Strategy: Choose an investment strategy that aligns with your risk tolerance and time horizon. * Diversification: Spread your investments across different asset classes and sectors to reduce risk. * Rebalancing: Periodically adjust your portfolio's asset allocation to ensure it remains aligned with your goals and risk preferences.

Strategies for Effective Asset Management:

* Seek professional advice from a financial advisor or wealth manager. * Consider using index funds or exchange-traded funds (ETFs) for low-cost diversification. * Rebalance your portfolio regularly to maintain your desired asset allocation. * Monitor your investments regularly and make adjustments as needed to respond to market conditions and your evolving financial needs.

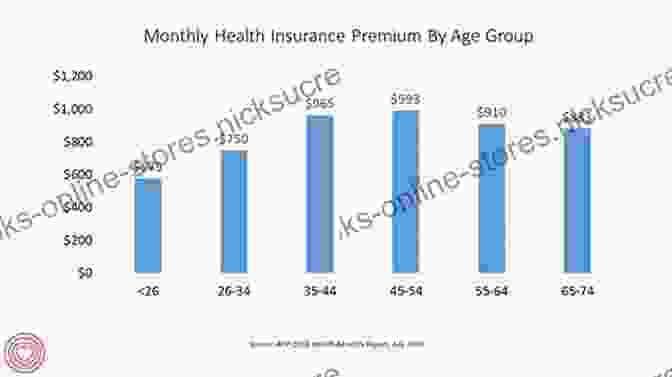

Medical Planning: Ensuring Access to Quality Healthcare

Medical planning is essential for managing healthcare costs and ensuring access to quality care. This includes understanding health insurance options, budgeting for medical expenses, and considering long-term care planning.

Key Considerations for Medical Planning:

* Health Insurance: Determine the type of health insurance plan that best meets your needs and budget. Options include employer-sponsored plans, individual plans, and government-sponsored programs like Medicare and Medicaid. * Medical Savings Accounts (MSAs): These tax-advantaged accounts allow you to set aside funds for qualified medical expenses. * Long-Term Care Insurance: Consider purchasing long-term care insurance to cover the potential costs of extended care in a nursing home or assisted living facility.

Strategies for Effective Medical Planning:

* Compare health insurance plans and choose the one that offers the best coverage and affordability. * Contribute to an MSA if eligible to reduce healthcare costs. * Explore long-term care insurance options and determine if coverage is appropriate for your circumstances. * Create a budget for healthcare expenses and set aside funds to cover expected costs.

Achieving financial security requires a multifaceted approach that encompasses retirement savings, Social Security, asset management, and medical planning. By understanding the key features and strategies associated with each of these components, you can create a comprehensive plan that will empower you to navigate the financial challenges of life and secure a future filled with financial stability and peace of mind.

4.5 out of 5

| Language | : | English |

| File size | : | 12489 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 269 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Joe Foster

Joe Foster Marie Louise Bruce

Marie Louise Bruce John French

John French Peter Kozodoy

Peter Kozodoy Aaron Sachs

Aaron Sachs Maureen Corrigan

Maureen Corrigan Dale Walker

Dale Walker Debbie Jorde

Debbie Jorde 11th Edition Kindle Edition

11th Edition Kindle Edition Gesshin Claire Greenwood

Gesshin Claire Greenwood Jeff Benedict

Jeff Benedict Jeffrey M Pilcher

Jeffrey M Pilcher Laura Palmer

Laura Palmer Thomas Sowell

Thomas Sowell Rebecca Solnit

Rebecca Solnit Anne Evers Hitz

Anne Evers Hitz Mateo Nicolas

Mateo Nicolas Denise B Dailey

Denise B Dailey Vanda Krefft

Vanda Krefft Nomavenda Mathiane

Nomavenda Mathiane

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Henry HayesThe Definitive Personal Assistant Secretarial Handbook: A Comprehensive Guide...

Henry HayesThe Definitive Personal Assistant Secretarial Handbook: A Comprehensive Guide... Allen GinsbergFollow ·14k

Allen GinsbergFollow ·14k Nathaniel HawthorneFollow ·19k

Nathaniel HawthorneFollow ·19k Brady MitchellFollow ·19.2k

Brady MitchellFollow ·19.2k Josh CarterFollow ·2.5k

Josh CarterFollow ·2.5k Charlie ScottFollow ·5.2k

Charlie ScottFollow ·5.2k Caleb CarterFollow ·10.6k

Caleb CarterFollow ·10.6k Fredrick CoxFollow ·18.7k

Fredrick CoxFollow ·18.7k Terry BellFollow ·8.5k

Terry BellFollow ·8.5k

Hank Mitchell

Hank MitchellStories of War from the Women Reporters Who Covered...

The Vietnam War was one of the most...

George Bell

George BellThe Hero and Saint of Islam: A Perennial Philosophy

Ali ibn Abi Talib,...

Samuel Ward

Samuel WardWhispers and Shadows: A Naturalist's Memoir of Encounters...

In her lyrical...

Clarence Brooks

Clarence BrooksRace, Gender, and Intellectual Property Rights in...

Dance is a powerful...

Kirk Hayes

Kirk HayesThe Political Odyssey of Nick Galifianakis: From...

The American...

Dean Butler

Dean ButlerGuibert of Nogent: A Portrait of the Medieval Mind

Guibert of Nogent was a...

4.5 out of 5

| Language | : | English |

| File size | : | 12489 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 269 pages |