Modern Methods of Valuation: A Comprehensive Guide and Comparison

Valuation is the process of determining the value of an asset. It is a complex and challenging task, and there is no one-size-fits-all approach. The most appropriate method of valuation will vary depending on the type of asset being valued, the purpose of the valuation, and the available data.

4.5 out of 5

| Language | : | English |

| File size | : | 14720 KB |

| Print length | : | 582 pages |

There are three main modern methods of valuation: the income approach, the cost approach, and the market approach. Each of these methods has its own advantages and disadvantages, and the best method for a given valuation engagement will depend on the specific circumstances.

The Income Approach

The income approach to valuation is based on the principle that the value of an asset is equal to the present value of its future cash flows. This approach is most commonly used to value businesses and income-producing properties.

There are a number of different income approaches to valuation, but the most common is the discounted cash flow (DCF) method. The DCF method involves forecasting the future cash flows of the asset and then discounting them back to the present at a rate that reflects the risk and uncertainty associated with the cash flows.

The income approach to valuation is relatively complex and requires a significant amount of data. However, it is generally considered to be the most accurate method of valuation, especially for businesses and income-producing properties.

The Cost Approach

The cost approach to valuation is based on the principle that the value of an asset is equal to the cost to replace it with a new asset of similar quality.

The cost approach is most commonly used to value real estate and other fixed assets. It is a relatively simple and straightforward method of valuation, and it does not require a significant amount of data.

However, the cost approach to valuation can be less accurate than the income approach, especially for assets that are not easily replaced.

The Market Approach

The market approach to valuation is based on the principle that the value of an asset is equal to the price that a willing buyer would pay for it in an open market.

The market approach is most commonly used to value publicly traded companies and other assets that are actively traded in a market.

The market approach to valuation is relatively simple and straightforward, and it does not require a significant amount of data.

However, the market approach to valuation can be less accurate than the income approach or the cost approach, especially for assets that are not actively traded in a market.

Which Method Is Right for You?

The best method of valuation for a given valuation engagement will depend on the specific circumstances.

The following factors should be considered when choosing a valuation method:

- The type of asset being valued

- The purpose of the valuation

- The available data

- The expertise of the valuer

In some cases, it may be necessary to use a combination of valuation methods to arrive at a fair value for an asset.

Valuation is a complex and challenging task, but it is essential for making informed decisions about the value of assets.

The three main modern methods of valuation are the income approach, the cost approach, and the market approach. Each of these methods has its own advantages and disadvantages, and the best method for a given valuation engagement will depend on the specific circumstances.

By understanding the different valuation methods and how to choose the most appropriate method for a given engagement, you can ensure that you are getting a fair and accurate valuation.

4.5 out of 5

| Language | : | English |

| File size | : | 14720 KB |

| Print length | : | 582 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Tom Fitzmorris

Tom Fitzmorris Luc Boltanski

Luc Boltanski Norah Vincent

Norah Vincent Abhishek Majumdar

Abhishek Majumdar A G Bradley

A G Bradley Kevin Richardson

Kevin Richardson James Edward Austen Leigh

James Edward Austen Leigh 3rd Edition Kindle Edition

3rd Edition Kindle Edition Lorakim Joyner

Lorakim Joyner Neville Duke

Neville Duke William Burtch

William Burtch David Cannadine

David Cannadine Ramli John

Ramli John Mihir A Desai

Mihir A Desai Dr Thomas O Mensah

Dr Thomas O Mensah Tiffany The Budgetnista Aliche

Tiffany The Budgetnista Aliche Tom Wright

Tom Wright Edgar Cayce

Edgar Cayce Michel Pratt

Michel Pratt Vandana Shiva

Vandana Shiva

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Eugene ScottOne Woman's Triumph: An Inspiring Journey Through the Challenges of Life in...

Eugene ScottOne Woman's Triumph: An Inspiring Journey Through the Challenges of Life in...

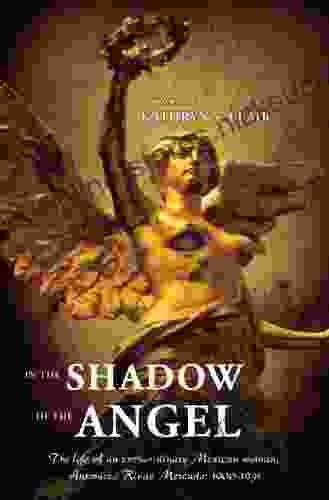

Fernando BellIn the Shadow of the Angel: An Exploration of the Historical and Literary...

Fernando BellIn the Shadow of the Angel: An Exploration of the Historical and Literary... Jeff FosterFollow ·13.7k

Jeff FosterFollow ·13.7k Arthur Conan DoyleFollow ·16.9k

Arthur Conan DoyleFollow ·16.9k Isaac MitchellFollow ·8.1k

Isaac MitchellFollow ·8.1k Dalton FosterFollow ·18k

Dalton FosterFollow ·18k Cooper BellFollow ·10.7k

Cooper BellFollow ·10.7k Michael CrichtonFollow ·17.5k

Michael CrichtonFollow ·17.5k Ian PowellFollow ·15.2k

Ian PowellFollow ·15.2k Cristian CoxFollow ·16.3k

Cristian CoxFollow ·16.3k

Hank Mitchell

Hank MitchellStories of War from the Women Reporters Who Covered...

The Vietnam War was one of the most...

George Bell

George BellThe Hero and Saint of Islam: A Perennial Philosophy

Ali ibn Abi Talib,...

Samuel Ward

Samuel WardWhispers and Shadows: A Naturalist's Memoir of Encounters...

In her lyrical...

Clarence Brooks

Clarence BrooksRace, Gender, and Intellectual Property Rights in...

Dance is a powerful...

Kirk Hayes

Kirk HayesThe Political Odyssey of Nick Galifianakis: From...

The American...

Dean Butler

Dean ButlerGuibert of Nogent: A Portrait of the Medieval Mind

Guibert of Nogent was a...

4.5 out of 5

| Language | : | English |

| File size | : | 14720 KB |

| Print length | : | 582 pages |