From Stocks and Bonds to ETFs and IPOs: An Essential Primer on Building a Diversified Portfolio

In the ever-evolving financial landscape, building a well-diversified portfolio is crucial for long-term success and risk management. Understanding the various investment vehicles available is essential for making informed decisions and achieving financial goals. This comprehensive guide will take you on a journey through the world of stocks, bonds, ETFs, and IPOs, providing an in-depth analysis of their features, advantages, and potential drawbacks.

4.6 out of 5

| Language | : | English |

| File size | : | 3938 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 313 pages |

Stocks: The Cornerstone of Investment Portfolios

Stocks represent ownership shares in publicly traded companies. When you invest in a stock, you become a part-owner of that company and are entitled to a portion of its profits (dividends) and potential capital appreciation (stock price increase). Stocks are considered a higher-risk, higher-return investment as they are directly tied to the performance of the underlying company. However, they also offer the potential for significant long-term growth.

Benefits of Investing in Stocks:

- Potential for High Returns: Stocks have historically outperformed other asset classes over the long term, offering investors the opportunity for substantial capital appreciation.

- Ownership in Companies: As a stockholder, you become a partial owner of the company, giving you a stake in its success and growth potential.

- Dividend Income: Many companies pay dividends to shareholders, providing a regular stream of income from your investments.

Risks of Investing in Stocks:

- Market Volatility: Stock prices can fluctuate significantly in the short term, exposing investors to potential losses.

- Company-Specific Risks: The performance of a stock is directly tied to the success of the underlying company, which may be affected by factors beyond your control.

- Limited Liquidity: Some stocks may have lower trading volumes, making it more difficult to buy or sell shares quickly.

Bonds: A More Conservative Investment

Bonds are debt instruments issued by governments and corporations to raise capital. When you invest in a bond, you lend money to the issuer and receive interest payments in return. Bonds are generally considered a lower-risk, lower-return investment compared to stocks. They provide a more stable source of income and are less volatile than stocks.

Benefits of Investing in Bonds:

- Regular Income: Bonds pay regular interest payments, providing a steady stream of income for investors.

- Lower Risk: Bonds are generally considered less risky than stocks as they represent a loan to the issuer, which is legally obligated to repay the debt.

- Diversification: Bonds can provide diversification to an investment portfolio, reducing overall risk.

Risks of Investing in Bonds:

- Lower Returns: Bonds typically offer lower returns compared to stocks, especially in a low-interest rate environment.

- Interest Rate Risk: Bond prices can be affected by changes in interest rates. Rising interest rates can lead to bond price declines.

- Credit Risk: The creditworthiness of the bond issuer determines the risk of default. Investing in bonds with lower credit ratings carries higher credit risk.

ETFs: A Basket of Investments

Exchange-traded funds (ETFs) are baskets of stocks, bonds, or other assets that trade on stock exchanges like individual stocks. They offer investors a diversified portfolio of investments in a single security. ETFs can track various indices, sectors, industries, or themes, providing investors with broad exposure to specific markets or strategies.

Benefits of Investing in ETFs:

- Diversification: ETFs provide instant diversification, as they hold a wide range of underlying assets.

- Low Cost: ETFs typically have lower fees compared to actively managed mutual funds.

- Tax Efficiency: ETFs are generally more tax-efficient than individual stocks or bonds.

Risks of Investing in ETFs:

- Tracking Error: ETFs may not perfectly track their underlying index or benchmark, which can result in performance deviations.

- Liquidity Risk: Some ETFs may have lower trading volumes, which can make it more difficult to buy or sell shares quickly.

- Issuer Risk: The creditworthiness of the ETF issuer can impact the fund's stability and performance.

IPOs: A Chance to Invest in New Ventures

Initial public offerings (IPOs) are the first time a privately held company offers its shares to the public. IPOs can provide investors with the opportunity to invest in promising new ventures and potentially participate in their growth. However, IPOs also come with a higher level of risk as the company's track record and financial performance may not be fully established.

Benefits of Investing in IPOs:

- Growth Potential: IPOs offer the potential to invest in early-stage companies with high growth potential.

- IPO Pop: Some IPOs experience a significant increase in share price immediately after going public, offering investors the potential for quick gains.

- Diversification: IPOs can provide diversification to an investment portfolio by adding exposure to newer and emerging companies.

Risks of Investing in IPOs:

- Higher Risk: IPOs involve higher risk as the company's financial performance and management team may not be fully tested.

- Lock-up Periods: IPO shares may have lock-up periods, restricting investors from selling their shares for a certain period.

- Market Volatility: IPOs can be subject to significant price volatility, especially in the early stages.

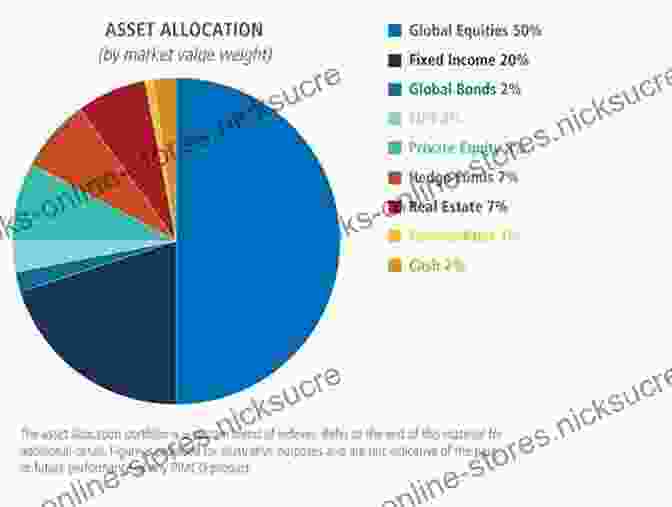

Building a Diversified Portfolio: Combining Different Asset Classes

The key to building a successful investment portfolio is diversification. By combining different asset classes with varying risk and return profiles, you can reduce overall portfolio volatility and increase the chances of achieving your financial goals. A well-diversified portfolio may include a mix of stocks, bonds, ETFs, and IPOs, tailored to your individual risk tolerance, investment horizon, and financial objectives.

The optimal asset allocation for your portfolio will depend on your specific circumstances and investment goals. If you are younger with a higher risk tolerance, you may consider a larger allocation to stocks and ETFs to potentially generate higher returns. As you age and approach retirement, you may gradually shift your portfolio towards bonds and other more conservative investments to preserve capital and minimize risk.

The world of investment can be both exciting and complex. By understanding the different investment vehicles available, you can make informed decisions and build a well-diversified portfolio that aligns with your financial goals and risk tolerance. Remember to regularly review and adjust your portfolio as your circumstances and market conditions change. With a disciplined approach and a long-term perspective, you can increase your chances of achieving financial success and securing your financial future.

4.6 out of 5

| Language | : | English |

| File size | : | 3938 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 313 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Sahl Syed

Sahl Syed Shawn P Williams

Shawn P Williams Nate Blakeslee

Nate Blakeslee Didier Eribon

Didier Eribon Theresa Hak Kyung Cha

Theresa Hak Kyung Cha Kathy Catrambone

Kathy Catrambone Steve Alvest

Steve Alvest Lon Safko

Lon Safko John J Heim

John J Heim Susan D Peters

Susan D Peters Roy Fullick

Roy Fullick Jennifer Grant

Jennifer Grant Lorna Stuber

Lorna Stuber Nathan Williams

Nathan Williams Matt Pavia

Matt Pavia Don Whitehead

Don Whitehead A Scott Berg

A Scott Berg Edward J Balleisen

Edward J Balleisen Michael Bauche

Michael Bauche Patrick N Hunt

Patrick N Hunt

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Alvin BellFollow ·8.9k

Alvin BellFollow ·8.9k Joshua ReedFollow ·4.9k

Joshua ReedFollow ·4.9k Brandon CoxFollow ·18.1k

Brandon CoxFollow ·18.1k Dustin RichardsonFollow ·6.3k

Dustin RichardsonFollow ·6.3k Gavin MitchellFollow ·17.3k

Gavin MitchellFollow ·17.3k Tennessee WilliamsFollow ·13.7k

Tennessee WilliamsFollow ·13.7k Alex ReedFollow ·18.1k

Alex ReedFollow ·18.1k Glen PowellFollow ·2.7k

Glen PowellFollow ·2.7k

Hank Mitchell

Hank MitchellStories of War from the Women Reporters Who Covered...

The Vietnam War was one of the most...

George Bell

George BellThe Hero and Saint of Islam: A Perennial Philosophy

Ali ibn Abi Talib,...

Samuel Ward

Samuel WardWhispers and Shadows: A Naturalist's Memoir of Encounters...

In her lyrical...

Clarence Brooks

Clarence BrooksRace, Gender, and Intellectual Property Rights in...

Dance is a powerful...

Kirk Hayes

Kirk HayesThe Political Odyssey of Nick Galifianakis: From...

The American...

Dean Butler

Dean ButlerGuibert of Nogent: A Portrait of the Medieval Mind

Guibert of Nogent was a...

4.6 out of 5

| Language | : | English |

| File size | : | 3938 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 313 pages |