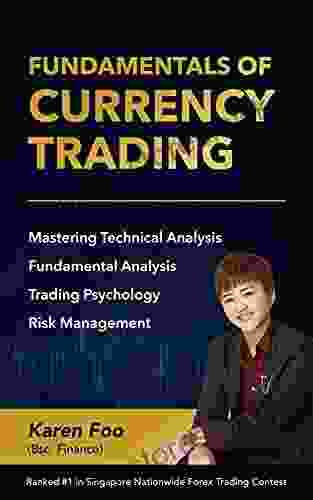

Comprehensive Guide to the Fundamentals of Currency Trading for Beginners: A Step-by-Step Guide to Success

to Currency Trading

Currency trading, also known as forex trading, is the buying and selling of different currencies in the foreign exchange market. It's one of the most liquid and actively traded markets in the world, with a daily trading volume of over $6 trillion.

4.9 out of 5

| Language | : | English |

| File size | : | 25067 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 308 pages |

| Lending | : | Enabled |

Traders in the forex market aim to profit from the fluctuations in currency exchange rates. They buy currencies that are expected to appreciate in value and sell currencies that are expected to depreciate.

Benefits of Currency Trading

- High Liquidity: Forex is the most liquid market in the world, making it easy to enter and exit trades quickly.

- 24-Hour Trading: The forex market is open 24 hours a day, 5 days a week, allowing traders to trade at any time.

- Leverage: Currency trading offers high leverage, which can amplify profits but also losses.

- Global Market: Forex is a global market, so traders can trade currencies from all over the world.

Risks of Currency Trading

- Market Volatility: Currency rates can fluctuate rapidly, leading to potential losses.

- Leverage: While leverage can amplify profits, it can also magnify losses.

- Lack of Regulation: The forex market is less regulated than other financial markets, which can increase risk.

Understanding Currency Pairs

In forex trading, currencies are traded in pairs. The first currency in the pair is called the base currency, and the second currency is called the quote currency.

The most commonly traded currency pair is the EUR/USD pair. This pair represents the exchange rate between the euro (EUR) and the US dollar (USD). If the EUR/USD pair is quoted at 1.1000, it means that one euro is worth 1.1000 US dollars.

Types of Currency Trading

There are two main types of currency trading:

- Spot Trading: This involves the immediate buying and selling of currencies.

- Forward Trading: This involves the buying and selling of currencies at a specified price in the future.

Market Analysis for Currency Trading

Successful currency trading requires a thorough understanding of market analysis. Traders use various techniques to analyze market conditions and make informed trading decisions.

Technical Analysis

Technical analysis involves studying historical price data to identify patterns and trends. Traders use technical indicators, such as moving averages and support and resistance levels, to make trading decisions.

Fundamental Analysis

Fundamental analysis involves studying economic and political factors that can affect currency prices. Traders consider factors such as interest rates, inflation, and economic growth when making trading decisions.

Risk Management in Currency Trading

Risk management is crucial in currency trading. Traders should implement strategies to limit potential losses and protect their trading capital.

- Stop-Loss Orders: Stop-loss orders are used to automatically close a trade if the price moves against you by a specified amount.

- Position Sizing: Traders should only risk a small portion of their trading capital on each trade.

- Hedging: Hedging involves using different trading strategies to offset the risk of another.

How to Get Started with Currency Trading

If you're interested in starting currency trading, follow these steps:

- Learn the basics: Educate yourself about currency trading, market analysis, and risk management.

- Choose a broker: Select a reputable and regulated forex broker.

- Open a trading account: Fund your trading account with enough capital to cover potential losses.

- Practice with a demo account: Most brokers offer demo accounts where you can practice trading without risking real money.

- Start trading small: Once you're comfortable with demo trading, start trading with small amounts of real money.

Currency trading can be a rewarding and profitable endeavor, but it also comes with risks. By understanding the basics, applying market analysis techniques, and implementing sound risk management strategies, you can increase your chances of success in the forex market.

Remember, the key to successful currency trading lies in continuous learning, practice, and discipline.

4.9 out of 5

| Language | : | English |

| File size | : | 25067 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 308 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare William Burtch

William Burtch Jack D Schwager

Jack D Schwager Bill Walsh

Bill Walsh Philip Handleman

Philip Handleman Amos Amir

Amos Amir Robert Miraldi

Robert Miraldi Alan G Robinson

Alan G Robinson Robert C Allen

Robert C Allen Didier Eribon

Didier Eribon Douglas Waller

Douglas Waller Kelly Treleaven

Kelly Treleaven Vicki Donlan

Vicki Donlan With French Flaps Edition Kindle Edition

With French Flaps Edition Kindle Edition James Gee

James Gee Grace Holmes

Grace Holmes Jodi Dinnerman

Jodi Dinnerman A Craig Copetas

A Craig Copetas Ann Wroe

Ann Wroe Patrick French

Patrick French Jean Webster

Jean Webster

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Levi PowellThe Ultimate Guide to Audition Songs for Women: A Comprehensive Resource for...

Levi PowellThe Ultimate Guide to Audition Songs for Women: A Comprehensive Resource for... Alan TurnerFollow ·10.1k

Alan TurnerFollow ·10.1k Jerry WardFollow ·14.8k

Jerry WardFollow ·14.8k Jacques BellFollow ·5.3k

Jacques BellFollow ·5.3k Juan ButlerFollow ·11.3k

Juan ButlerFollow ·11.3k Earl WilliamsFollow ·14.4k

Earl WilliamsFollow ·14.4k Ray BlairFollow ·3.4k

Ray BlairFollow ·3.4k Phil FosterFollow ·12.3k

Phil FosterFollow ·12.3k Drew BellFollow ·4.2k

Drew BellFollow ·4.2k

Hank Mitchell

Hank MitchellStories of War from the Women Reporters Who Covered...

The Vietnam War was one of the most...

George Bell

George BellThe Hero and Saint of Islam: A Perennial Philosophy

Ali ibn Abi Talib,...

Samuel Ward

Samuel WardWhispers and Shadows: A Naturalist's Memoir of Encounters...

In her lyrical...

Clarence Brooks

Clarence BrooksRace, Gender, and Intellectual Property Rights in...

Dance is a powerful...

Kirk Hayes

Kirk HayesThe Political Odyssey of Nick Galifianakis: From...

The American...

Dean Butler

Dean ButlerGuibert of Nogent: A Portrait of the Medieval Mind

Guibert of Nogent was a...

4.9 out of 5

| Language | : | English |

| File size | : | 25067 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 308 pages |

| Lending | : | Enabled |